The Symphony of a Thousand Spreadsheets

Picture this: It’s the last week of the quarter. For the finance department of a global enterprise, it’s not just a week; it’s a high-stakes performance. A symphony of a thousand spreadsheets, each a different instrument playing a critical part. But the conductors—the CFO, the controllers, the analysts—are exhausted. They’re manually reconciling data from disparate ERP systems, chasing down approvals across time zones, and praying a single copy-paste error doesn’t bring the entire composition to a screeching halt.

Does this sound familiar? For many large organizations, this “controlled chaos” is simply the cost of doing business at scale. The processes, once designed for a smaller, simpler company, have been patched and propped up over years of growth, acquisitions, and global expansion. They work, but at a tremendous cost—not just in hours, but in risk, morale, and missed strategic opportunities.

We’ve been conditioned to believe that this is the peak of financial management. But what if the goal isn’t just to conduct the chaos, but to fundamentally change the music? This is the promise of Financial Process Automation (FPA), a strategic shift that’s moving the world’s largest finance teams from being reactive record-keepers to proactive value-drivers.

The Hidden Tax of Manual Processes

Before we dive into the ‚how‘ of automation, let’s be honest about the ‚why‘. The reliance on manual and semi-automated processes in enterprise finance isn’t just inefficient; it’s a hidden tax on your organization’s potential. Think of it in three distinct ways:

- The Financial Tax: This is the most obvious. It’s the cost of errors. A study by F1F9 found that a staggering 88% of spreadsheets contain errors. In a multi-billion dollar organization, a single misplaced decimal in a forecasting model isn’t a rounding error; it’s a potential crisis. Add to this the sheer cost of labor for repetitive tasks, and the numbers become impossible to ignore.

- The Opportunity Tax: Your brightest financial minds—the ones you hired for their analytical prowess—are spending their days buried in data entry, validation, and reconciliation. Every hour they spend on manual drudgery is an hour they aren’t spending on strategic financial planning, M&A analysis, or identifying new revenue streams. Your team is too busy bailing water to help steer the ship.

- The Talent Tax: Top finance talent today doesn’t aspire to be a spreadsheet guru. They want to work with modern tools that empower them to make a tangible impact. An outdated, manual-heavy tech stack is a major red flag for ambitious professionals, making it harder to attract and retain the people who can truly move your business forward.

Clinging to these legacy processes is like trying to navigate a superhighway in a horse-drawn carriage. You might eventually get there, but you’re slow, vulnerable, and being lapped by the competition.

Beyond the Buzzwords: What FPA Really Means at an Enterprise Scale

Financial Process Automation isn’t about buying a single piece of software that magically solves everything. It’s a strategic approach that layers different technologies to create a seamless, intelligent financial ecosystem. For a large organization, this typically involves a blend of a few key technologies:

Robotic Process Automation (RPA): The Digital Workforce

Think of RPA as a team of highly efficient digital employees. These software “bots” are perfect for handling the high-volume, rules-based, and repetitive tasks that bog down your team. They don’t replace humans; they augment them by taking over the most tedious work. They log into applications, move files, copy-paste data, and fill in forms, just like a person would, but 24/7, without errors, and at lightning speed.

Real-world enterprise example: A global manufacturing company had a team of 30 people dedicated to processing over 50,000 supplier invoices per month. By implementing RPA, they automated 85% of the process—from extracting data from PDF invoices using Optical Character Recognition (OCR) to matching them with purchase orders in their SAP system and flagging exceptions for human review. The result? The month-end close for accounts payable went from five days to one, and the team was re-skilled to focus on vendor relationship management and cash flow optimization.

Artificial Intelligence (AI) and Machine Learning (ML): The Strategic Brain

If RPA is the workforce, AI and ML are the brain. These technologies go beyond simple rules to handle complexity, make predictions, and learn from data. In finance, their applications are transformative:

- Intelligent Document Processing: AI can read and understand complex, unstructured documents like contracts or non-standard invoices, something basic RPA struggles with.

- Anomaly and Fraud Detection: ML algorithms can analyze millions of transactions in real-time to spot patterns indicative of fraud that would be impossible for a human to detect.

- Predictive Forecasting: Instead of relying solely on historical data, ML models can incorporate external factors (market trends, supply chain data, economic indicators) to create far more accurate and dynamic financial forecasts.

Integration and Orchestration: The Central Nervous System

For a large organization, the biggest challenge is often the spaghetti junction of legacy systems: multiple ERPs from past acquisitions, homegrown databases, and a dozen different SaaS tools. True FPA connects these disparate systems. Modern automation platforms act as a central nervous system, orchestrating workflows across applications, ensuring data flows seamlessly from your CRM to your ERP to your financial planning and analysis (FP&A) software without manual intervention.

The Enterprise Roadmap: From Pilot to Transformation

The prospect of overhauling decades-old financial processes can feel daunting. The key is to avoid a “big bang” approach. A successful enterprise-wide FPA journey is a marathon, not a sprint, built on a series of strategic wins.

Step 1: Identify the High-Impact, Low-Complexity Starting Point

Don’t try to automate your most complex, judgment-based process first. Look for the “low-hanging fruit.” Where is the pain most acute? Which processes are both high-volume and highly standardized? Excellent candidates often include:

- Accounts Payable (AP) Automation: Invoice intake, data extraction, and three-way matching.

- Expense Report Processing: Auditing reports against company policy and flagging exceptions.

- Bank Reconciliations: Matching thousands of transactions between bank statements and the general ledger.

Starting here delivers a quick, measurable ROI, which builds momentum and secures buy-in for more ambitious projects down the line.

Step 2: Build Your Cross-Functional ‚Center of Excellence‘ (CoE)

FPA is not just a finance project, and it’s not just an IT project. It’s a business transformation initiative. A successful rollout requires a dedicated CoE comprising stakeholders from:

- Finance: The process owners who understand the ‚what‘ and ‚why‘.

- IT: The technical experts who understand the systems, security, and integration.

- Operations: The people on the ground who will use and interact with the new automated processes.

- Change Management: The specialists who will manage communication, training, and the human side of the transition.

Step 3: Choose a Partner, Not Just a Platform

The market is flooded with automation tools. For a large organization, the technology itself is only part of the equation. You need a technology partner that understands the complexities of enterprise-grade security, scalability, and governance. Ask potential vendors tough questions: How does your platform handle thousands of bots? What are your protocols for data security and compliance with regulations like SOX and GDPR? Can you show us case studies from companies of our scale and in our industry?

Step 4: Measure, Iterate, and Scale Intelligently

For your initial pilot, define clear KPIs. Don’t just track “time saved.” Measure everything: processing cost per invoice, error reduction rate, employee satisfaction scores, and days to close the books. Use the data from your pilot to refine the process and build a business case for the next phase. Scaling isn’t about automating everything at once. It’s about creating a repeatable framework—a factory model—for identifying, vetting, building, and deploying automations across the entire finance function.

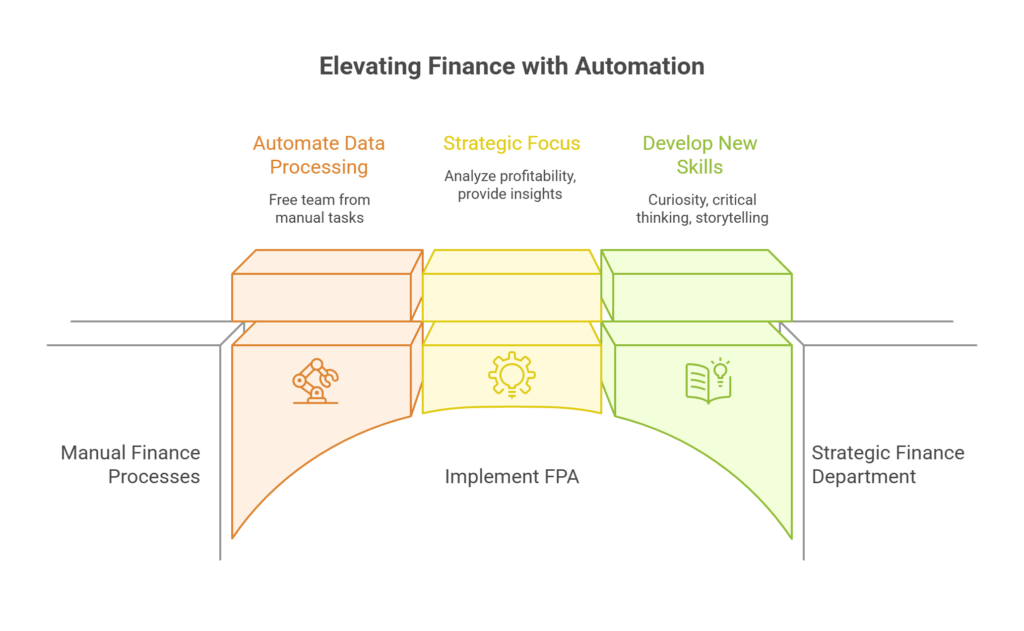

The New Finance Professional: From Calculator to Strategist

Let’s address the elephant in the room: What does this mean for the people in your finance department? The fear that automation will eliminate jobs is pervasive, but the reality is more nuanced and, frankly, more exciting. FPA doesn’t eliminate the need for financial professionals; it elevates their role.

When you free your team from the shackles of manual data processing, you empower them to become what they were always meant to be: strategic partners to the business. The analyst who spent 20 hours a week reconciling accounts can now spend that time analyzing the drivers of profitability. The controller who spent days chasing down data for the quarterly report can now focus on providing forward-looking insights to the executive team.

The future of finance isn’t about being the fastest person with a calculator or a VLOOKUP formula. It’s about curiosity, critical thinking, and the ability to translate complex financial data into a compelling business story. Financial Process Automation provides the tools to do just that, turning the finance department from a cost center into a powerful engine for growth and innovation.

So, look again at your symphony of spreadsheets. Is it playing the music you want your organization to be known for? Or is it time to introduce a new set of instruments and compose a masterpiece of efficiency, insight, and strategic control?